Rutland HUBZone and NMTC

Rutland City offers qualifying businesses several unique

opportunities to capitalize on Federal economic

development programs.

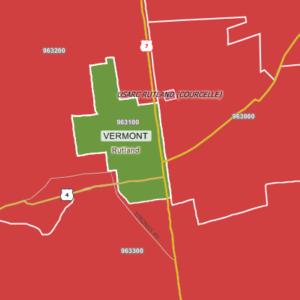

Sections of Rutland City encompass Qualified U.S. Census Tracts making them eligible for programs such as the U.S. Small Business Administration’s HUBZone Program and the U.S. Treasury Department’s New Market Tax Credit programs.

HUBZone Program

This program encourages economic development through the establishment of preferences in government contracting. To become HUBZone certified a small business must maintain its principal office within a qualifying census tract, be at least 51% owned and controlled by U.S. citizens, and employ at least 35% of its workers from within the HUBZone.

Rutland small businesses meeting these criteria will see benefits including competitive and sole source contracting, 10% price evaluation preference in full and open competitions, and subcontracting opportunities. The Federal government has a goal of awarding 3% of all dollars to HUBZone certified small businesses. For more information contact the RRA or visit http://www.sbagov/hubzone/

New Market Tax Credit Program

This program was created in 2000 to spur investment of private capital for economic development. It allows individual and corporate taxpayers the ability to receive income tax credit by making a qualifying investment that will stimulate economic growth and job creation in specifically targeted communities. Parts of Rutland City encompass a qualifying NMTC census tract.

Vermont Rural Ventures is the qualified Community Development Entity (CDE) responsible for securing NMTC allocations and administering the program in Vermont. Rutland City recently saw this program used effectively in the construction of a new 32,000 SF Community College of Vermont campus in downtown Rutland. For more information contact the RRA or visit http://www.hvt.org/vermont-rural-ventures/